Nothing worthwhile comes for free. I have sold my proposition to an investor for 21,000.00 Euro.

I need funds to pay for my tuition, housing, food, books, flights, insurance, and so on. I have applied for a number of scholarships but won't have the earliest results until December and January. Meanwhile, most of my tuition is due before the New Year.

According to the terms of a loan I have taken out with a financial institution, I am not allowed to borrow money elsewhere to secure the remaining funds. Thus, I am selling this investment instead – my most significant asset is the net present value of my future earnings. I will be repaying my loan to the financial institution at a rate of 715.12 Euro per month, which leaves plenty of space for this auction.

If you have any questions or comments please click here.

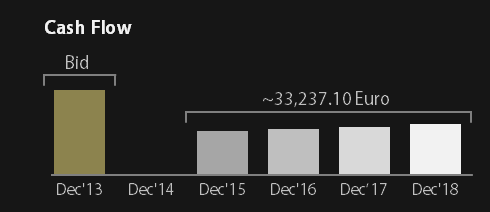

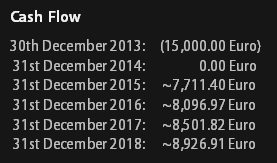

To gather the remaining funds necessary for my studies at INSEAD's MBA programme, I am auctioning off 10% of my net income, for a period of 4 years starting the day of my first full-time job post MBA, to be paid at the end of each 12 month period. Further, I will guarantee that my total payments to you will be at least your winning bid and additional 10,000.00 Euro.

To download my proposed legal instrument click here.

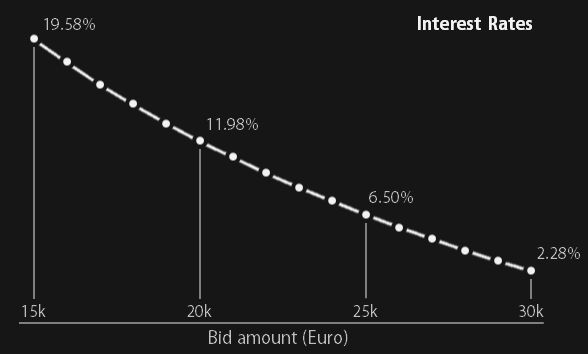

As the value of the winning bid rises, the effective rate of the return on the investment falls – because the investor’s positive cash flow remains the same. At 15,000.00 Euro the investor will get a 19.58% annual return on their investment and easily more than double their initial investment.

If you have any questions or comments, or to request the full details of the agreement, the math behind it, my budget, and my CV, please click here.

Applying English taxation to the average gross income, excluding annual and sign-on bonuses, for newly minted INSEAD MBAs in their year first gives a net income of 77,114.00 Euro after tax.

The net present value of my proposition is 21,642.00 Euro - I'm offering it to the highest bidder for a minimum of 15,000.00 Euro. I’m using English taxation, a 10% discount rate, and an average of 5% annual salary increase in my calculation. This will cover my remaining financial need.I'll be happy to go over the details of the calculations with you and provide you with the spread sheet. It is all very sound.

To download my spread sheet with all the math and some explanations click here.

All of the above risks have been further explored on the Q&A page, click here to view them.